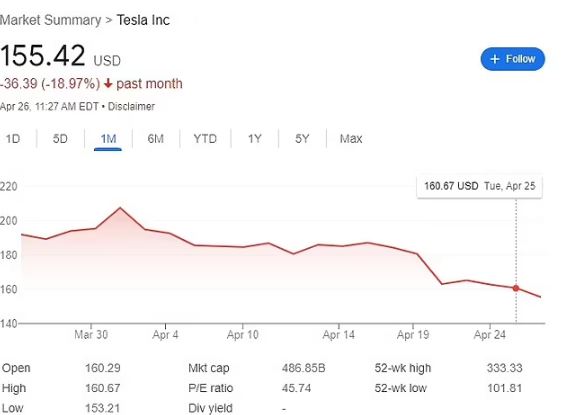

Over the past 26 days, Tesla has lost $143 billion in market value, mainly due to Elon Musk’s aggressive price cuts and failure to meet predicted delivery rates for the first quarter. The company has reduced prices seven times this year, with the latest cut on the Model Y, which now costs $46,990, $759 less than the average US vehicle. Additionally, the company was expected to deliver 432,000 vehicles in the first quarter but fell short by more than 9,000 units. These aggressive cuts and low delivery rates have caused the company’s stock to plummet from $207 on March 31 to $155.42 currently. The plummeting stocks have caused a loss in value for investors and seen the market valuation drop from $657 billion at the end of last month to around $513 billion.

These price cuts are Musk’s attempt to boost sales amidst lower demand for Tesla’s vehicles. However, the dramatic drop in stock prices has caused major Tesla investors to write an open letter to the board of directors, demanding that they keep Musk on a short leash. Investors are concerned that Musk’s over-commitment to multiple companies may jeopardize Tesla’s long-term value and take substantial legal, operational, and reputational risks.

Moreover, Tesla’s low first-quarter delivery rates and the aggressive price cuts have caused the company’s gross margins to drop to their lowest level in two years, missing market estimates. This strategy has raised concerns about a price war breaking out in Tesla’s core China market, which could weigh on shares after a meteoric start to the year. However, analysts like Managing Director Dan Ives believe that the price cuts may cause near-term margin pain but could result in long-term demand gain.

Jefferies recently downgraded Tesla’s stocks to Hold from Buy after the EV maker warned on the last week’s earnings call that it is likely to continue cutting prices to boost demand for its products. Jefferies also cut its estimates for 2023, expecting Tesla to deliver 1.79 million units with an average selling price of $46,000. Tesla bull Gary Black has criticized the company’s price cuts, saying that they don’t make sense and that the company needs to teach people why EVs are better.

In conclusion, Tesla’s aggressive price cuts and failure to meet predicted delivery rates have caused the company’s stock to plummet, causing a loss in value for investors. These price cuts have raised concerns about a price war breaking out in Tesla’s core China market and may cause near-term margin pain. However, analysts like Dan Ives believe that the price cuts could result in long-term demand gain. Additionally, major Tesla investors have written an open letter to the board of directors, expressing concerns about Musk’s over-commitment and the company’s legal, operational, and reputational risks.