Europe Historic Shift to Electric Cars

In recent years, the European car market has witnessed a significant shift with the rise of battery-electric vehicles (BEVs). Traditionally, diesel cars have been popular in Europe due to higher gasoline prices compared to other regions. This preference for diesel cars has made it challenging to find affordable non-diesel options, especially small hatchbacks and large sedans, particularly in the UK. Despite the Volkswagen diesel crisis affecting various brands, the demand for diesel cars remained strong in some European markets.

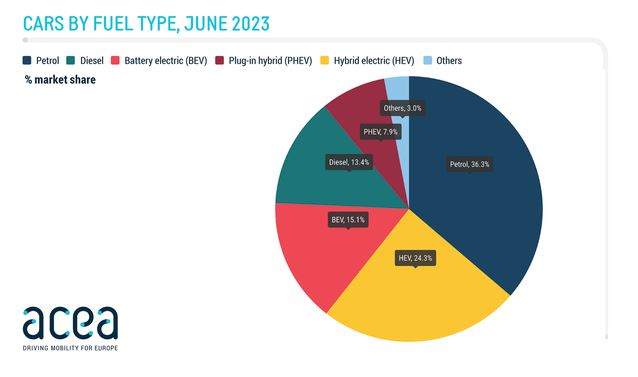

However, a remarkable change is now underway, as sales of new battery-electric models have surpassed those of diesel cars for the first time ever. According to data from June 2023 published by Europe’s auto manufacturer association ACEA, BEVs accounted for 15.1% of the market, showing a significant increase of 66.2% compared to the same month in 2022 when they held 10.7% market share in the European Union.

The growth of battery-electric vehicles has not been uniform across all EU countries. The Netherlands experienced the highest gain at 90.1%, while Germany and France followed in second and third places with gains of 64.4% and 52.0%, respectively.

Despite the surge in electric car sales, gasoline-powered models still maintain their dominance in the European market with a 36.3% market share, while hybrids hold the second position at 24.3%.

Interestingly, the popularity of plug-in hybrid electric vehicles (PHEVs) has fluctuated in various EU markets. While Spain witnessed a significant increase of 51.7% in PHEV market share, Germany, on the other hand, experienced a decline of 39.2% in PHEV sales over the past year.

The rising trend of battery-electric models has led to questions about its underlying causes. Is the surge solely driven by the popularity of BEVs, or is it a consequence of regulatory actions against diesel cars? In recent years, many major cities in Europe have implemented bans on diesel cars in city centers, and the European Parliament has set a target for zero-emission car sales by 2035. Additionally, the decade-old Volkswagen diesel crisis had a lasting impact on diesel car demand, affecting brands such as Audi, Skoda, and SEAT.

Despite the overall decline in diesel car popularity, they are still gaining traction in specific countries like Romania and Germany. Diesel cars are expected to remain popular in smaller Eastern European markets both within and outside the EU.

It is noteworthy that some of the most popular electric car models in Europe are not produced by European automakers. Tesla’s Model Y, for instance, has emerged as the best-selling car overall in the first six months of 2023, easily dominating the BEV market. Furthermore, Chinese-made electric vehicles are gaining prominence in the European market, a trend that was not widely anticipated by market analysts a few years ago.

In conclusion, the European car market is experiencing a significant shift with the surge of battery-electric vehicles. Although diesel cars have been favored for decades, the growing popularity of electric cars, along with regulatory efforts and emerging non-European automakers, are reshaping the landscape. The future of diesel cars remains uncertain, while the electrification of the European car market continues to gather momentum.